Is it worth investing just $100 a month?

The Stash App is a very user-friendly platform that makes investing in stocks, bonds, and ETFs easier than losing a 10mm socket. The user interface and user experience are so clean and simple that even the grandma that needs help turning on Netflix could navigate herself to buy shares of Tesla. All of that is just $4 per month and right on your phone. Sounds like the easiest way to start investing.

Risk It For The Biscuits

“The biggest risk of all is not taking one”.

—Melody Hobson, Co-CEO of Ariel Investments

Everything is risky, but investing is a manageable risk. The Stash app helps you find out how much risk you’re willing to take with the guided Stash risk assessment that will set your risk profile. There are three risk tolerances: conservative, moderate, or aggressive.

Conservative: you rather have smaller gains for the least downside as possible.

Moderate: you want long-term growth potential, some risk, and some stability.

Aggressive: you are not scared of the downside and want the most growth.

The three major factors that Stash uses to help determine your risk tolerance are your age, your income, and your saving goals. If you are young you most likely are thinking in the long term, which leads to typically a more aggressive tolerance. If you are new to investing and do not have much income to invest you probably want smaller gains and the least amount of downside as possible (conservative risk tolerance).

The Stash app helps you determine your risk tolerance so you can decide if you want to risk it for the biscuits or slowly grow your way to potential financial freedom.

The Catch

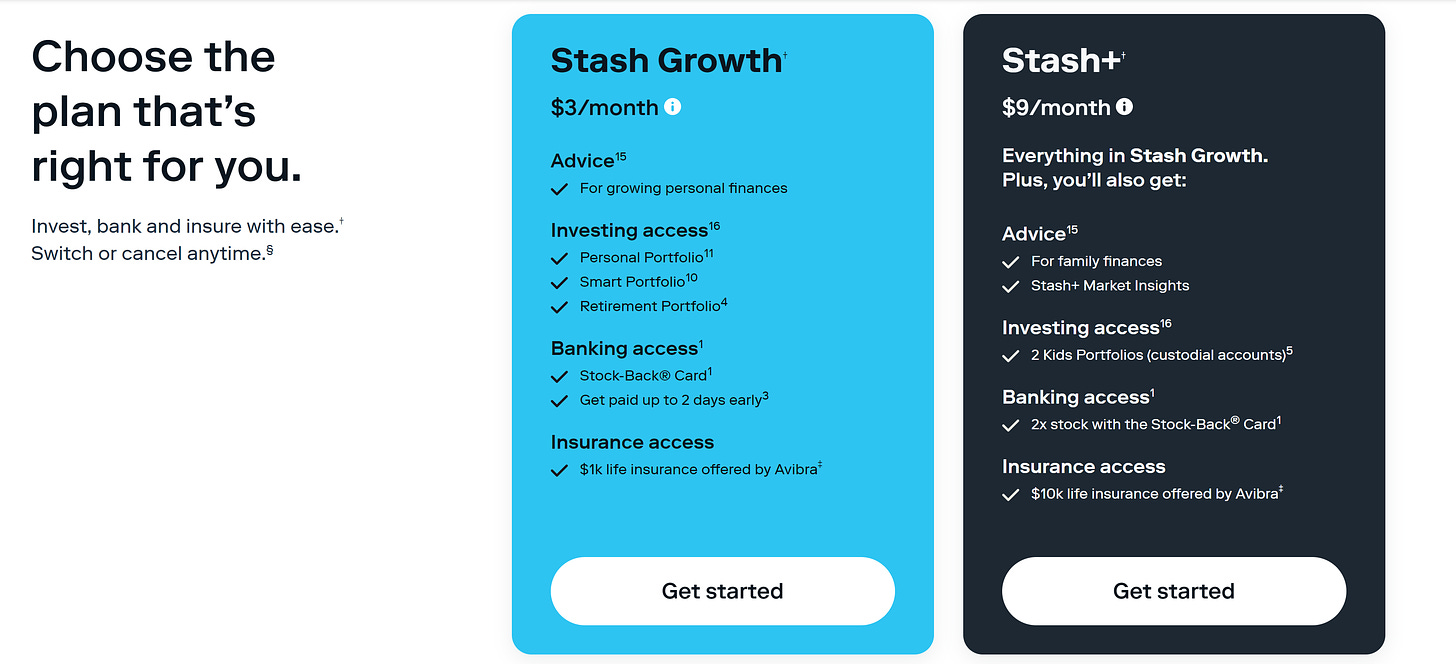

The subscription-based model of Stash is unique. It costs you $3 per month for the basic use of Stash plus you are required to put $1 into your account for a grand total of $4. You can automate investing and set up reoccurring investments to dollar cost average into your future financial freedom!

This “Stash Growth” plan also offers a “stock-back” card and $1,000 life insurance offered by Avibra. In addition, a $9 per month subscription gives you two kids’ custodial accounts, 2X “stock-back”, and $10,000 life insurance.

Buy fractional shares:

Dollar-cost-averaging (DCA) is a strategy that has been tried and true in the world of investing. Buying on regular intervals, for example, $100 of your stock of choice every month. However, that stock price is $1000, so how can you buy $100?

The Stash App allows you to buy fractional shares. So if you want to buy $25 a week of your favorite stock, you can! It’s a great way to DCA into the markets.

Securities Lending Program

Last but not least, is their securities lending program. Let’s say you set up reoccurring deposits (every payday) for $20 and stack up some cash to buy 1 share of Apple stock. As a whole share owner Stash lends out your securities so that other stashers can buy fractional shares and you reap some extra income benefits. You can read more about that here.

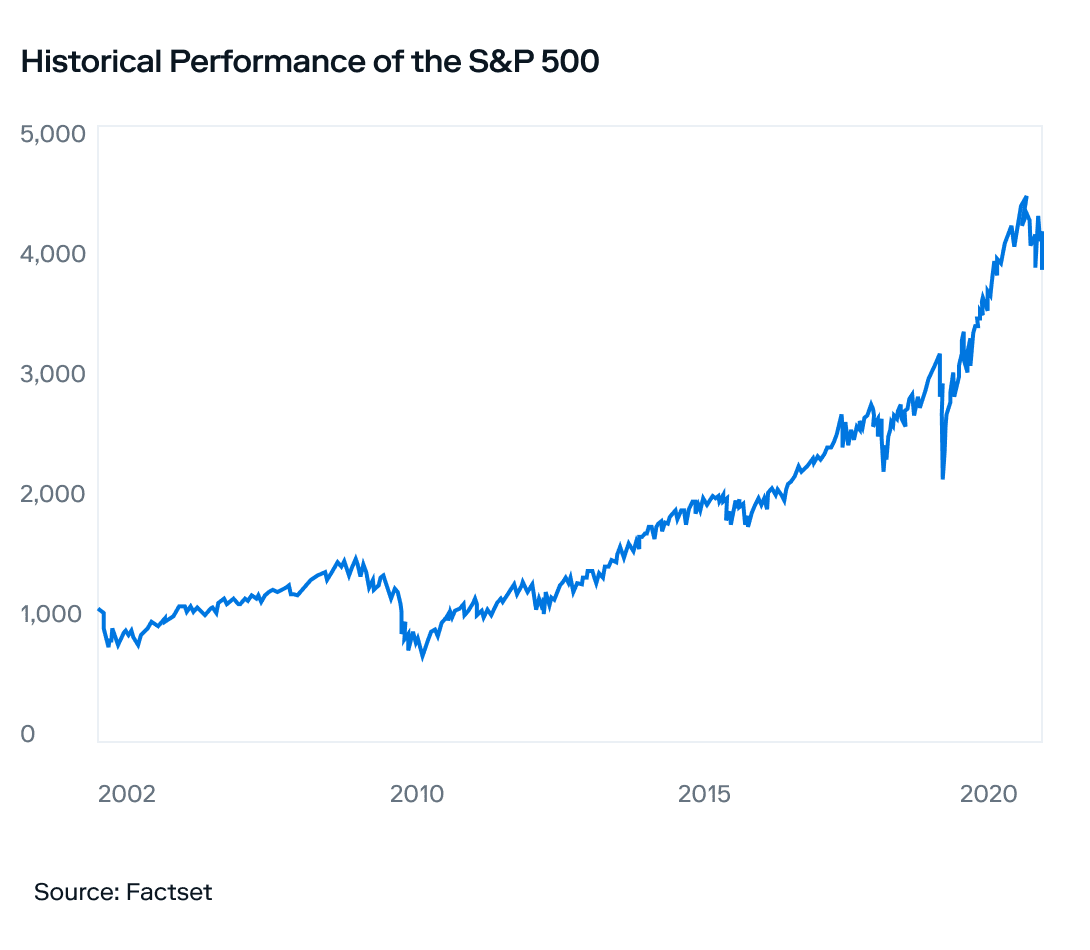

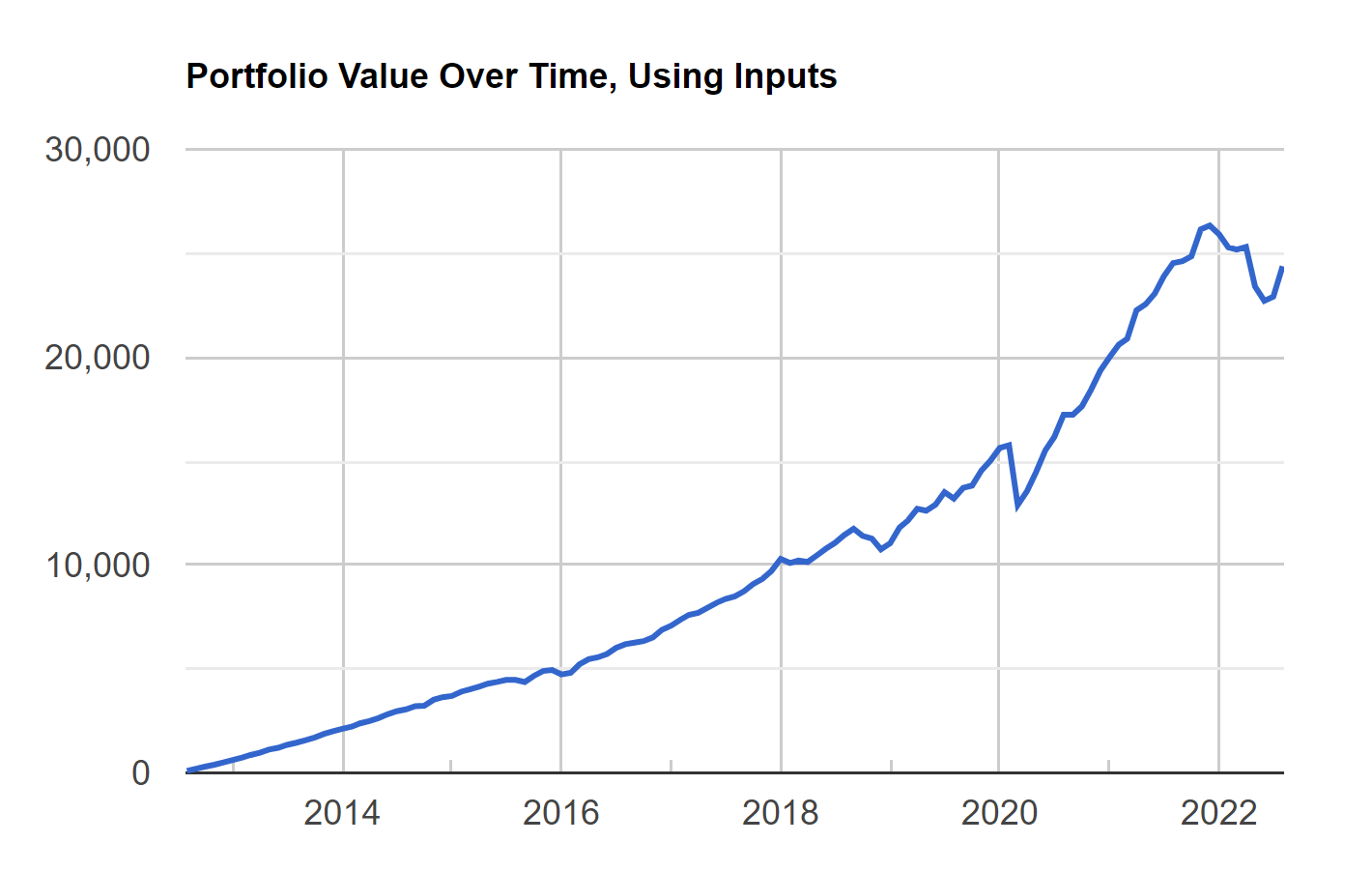

For this example, the person invests $100 every month into the S&P 500 for ten years starting in the year 2012. The total amount invested would be $12000. The estimated portfolio value based on historical returns would be $22600.

Automation

Time is one of, if not the most valuable asset. Stash automation helps users create a “set it and forget it” type portfolio. Stash offers automated weekly deposits straight from your checking account. Then you can automatically buy that $25 of stock every week. You can change the amount and frequency any time you feel the need. Stash automation is great for saving your precious time.

Overall

Stash is easy, cheap, and efficient. The ease of use within the app is great for the computer illiterate. A cheap solution to investing that simplifies the process. Stash makes it easy to just start, starting with $10 or $100 a week or however much you feel comfortable with determined by your risk tolerance. Lastly, Stash is efficient with weekly direct deposits, and automated purchases making DCA(dollar-cost-averaging) the easiest thing you could do when it comes to stocks.

If you want to get started investing with Stash today you can use my link and get up to $20 in stock!

Take Action:

📘 Read Investing Basics

📺 Watch Intro to Mutual Funds

Not financial advice. This newsletter is strictly educational and is not financial advice. Do your own research.

Disclosure. From time to time we may add links in this newsletter to products we use. We may receive a commission if you make a purchase through a link.